Those who invest in Bitcoin primarily believe in the decentralized structure, resulting in the independence and security of digital currencies. However, which dangers threaten the Bitcoin network? Which are really serious, and what role does the human factor play here?

The 51 percent attack on the Bitcoin network has repeatedly come to the fore as a potential worst-case scenario. We will explain to you below what this is all about and estimate the potential danger. So, just how dangerous is a 51 percent attack for Bitcoin?

Table of Contents

So what is a 51 percent attack on Bitcoin?

Out of all the potential threats to Bitcoin, a 51 percent attack is probably the most prominent. However, just what is a 51 percent attack in the first place? We look at the definition of Bitcoin again for this.

Bitcoin is a digital currency that works in a decentralized manner. You can use it for the transfer of value and the storage of value.

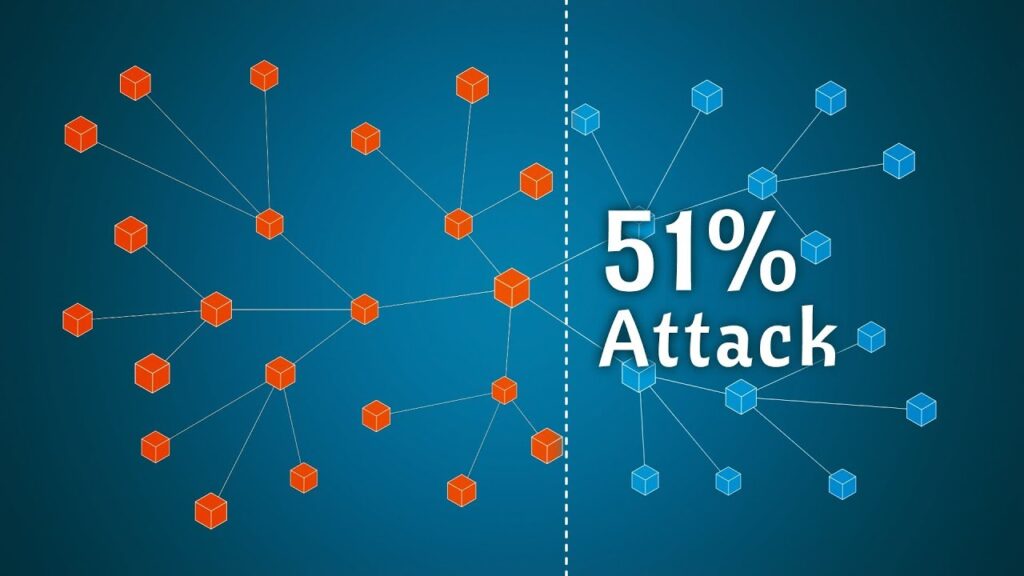

Decentrality is particularly important here. The bitcoin blockchain is maintained by thousands of different nodes, i.e. distributed nodes. Accordingly, also the mining network is decentralized.

Typically, what constitutes a 51 percent attack on a blockchain by a group of miners is an attack in which the miners collectively control more than 50 percent of the network’s mining hash rate.

Prerequisites for a 51 percent attack on Bitcoin

Of course, an attack like this is not readily possible. So, let’s look at what is needed for a 51 percent attack. Essentially, there are two factors involved here.

Processing power for a 51 percent attack

To control more than 50 percent of the mining network, an enormously high level of computing power is needed first of all. In practice, any party is more than unlikely to be able to muster this computing power.

At the same time, the bitcoin network has grown so rapidly in recent years that ever greater computing power is necessary. Thus, the highest probability for a 51 percent attack might have been at the beginning of the Bitcoin network. However, it was not an easy task, as many people still lacked the know-how for such an attack.

This chart illustrates how quickly and enormously the mining network has grown in recent years. Here, the proof of work process, often criticized because of its environmental footprint, is also an advantage.

The Cost of a 51 Percent Attack on Bitcoin

Here is where the next factor comes into play that makes this attack unrealistic: cost. It would cost so much money to maintain this computing power and carry out the attack that it is simply not worth it. This is particularly true for quantum computing. The cost of a potential 51 percent attack also increases along with the network hashrate.

Andreas Antonopoulos, for instance, at the time estimated the cost of a 51 percent attack at around one billion U.S. dollars. So the “hackers” would have to capture more than 16,666 Bitcoin and sell them for $60,000 to cover the costs alone. In the meantime, the estimates even range to 15 billion US dollars and more.

In all probability, bitcoin mining would probably be more profitable for the attackers in this case. Perhaps, the attackers are not pursuing any financial gain in that case, however. An attack like this could also serve to merely damage Bitcoin’s reputation.

So what happens in the case of a 51 percent attack?

Nonetheless, we assume that the attackers manage to control more than 50 percent of the mining pool. And even then, simple bad luck could prevent them from gaining control of the next block. Although the probability is high, it’s not a fact in advance.

Let’s say a successful 51 percent attack occurs. Would this mean the end of bitcoin? Then what do users of the Bitcoin network have to fear?

It is essential to keep in mind that a successful 51 percent attack only gives attackers control over the next block of the blockchain. The next step would be a so-called Doublespend. However, costs are not even remotely related to the potential return.

It simply does not make sense for the attackers, even in the case of a long-term takeover of the Bitcoin network. Ultimately, what would happen is that a 51 percent attack would be noticed so that nobody would use the hacked version of the Bitcoin blockchain anymore. Rather, the rest of the participants would switch to a fork, i.e. a forked Bitcoin version.

This would make Bitcoin worthless – but only the old, cracked version. However, the loss of trust mentioned above that would accompany a 51 percent attack would most likely be extensive.

Also Read:

- Binance Review (2022): Is It the Best Crypto Exchanges Out There?

- The Secret Formula of the Profitable Bitcoin & Crypto Trading

- All You Need to Know about Bitcoin and Other Cryptocurrencies: Mining, Buying, Understanding

What is the likelihood of a 51 percent attack on Bitcoin?

So we can conclude that a 51 percent attack on Bitcoin is improbable. Altcoins, which require much less computing power, are much more susceptible to this.

This keeps the costs for a 51 percent attack within bounds – at least compared to the attack on the Bitcoin network. Successful 51 percent attacks have already been carried out.

Prominent examples are Ethereum Classic, Verge and Bitcoin Gold. However, the required computing power is not nearly in contrast to the attack on the Bitcoin network.

Threats to Bitcoin: What else can be dangerous for BTC?

We now know that the 51 percent attack remains a theoretical danger for Bitcoin but is very unlikely in this case. We will therefore look at two other potential threats to Bitcoin below.

Just what will happen to Bitcoin in the event of a blackout?

However, cryptocurrencies such as Bitcoin are digital money. The globally distributed nodes mean that, unlike centralized networks, a server failure is, in principle, not to be feared. However, widespread power outages caused by natural disasters or electromagnetic pulses become problematic.

However, it is naive to believe that this scenario only affects cryptocurrencies. Traditional financial systems would also be severely affected by a widespread internet outage.

Mainly since it is much easier to set up a decentralized structure afterwards than a centralized network.

In a complete blackout, the bitcoin network would be virtually frozen. However, BTC holders would not have lost their Bitcoins and could dispose of their Bitcoins after the restart.

The biggest danger for Bitcoin: Crypto ban by politics

If it is up to Andreas Antonopoulos, however, politics poses the greatest threat to Bitcoin. While he believes that a complete ban of Bitcoin in the Western world is relatively unlikely, bitcoin could nevertheless be endangered, thereby a slow infiltration.

Besides a ban, the list of potential risks for Bitcoin includes higher taxes and levies on Bitcoin ownership.

In addition, there could be moves to curb decentralized digital currencies as soon as more central banks rely on their own digital central bank currency. This step, however, would primarily put stablecoins under pressure.

While Andreas Antonopoulos had argued that a ban on Bitcoin might be likely, particularly in developing countries, emerging economies are rising to become a driving force and are promoting crypto adoption immensely.

Already, China has banned any transactions with bitcoin and cryptocurrencies. On the other hand, as of September 7, 2021, El Salvador has become the first country to adopt Bitcoin as legal tender.

This, in addition to being an opportunity, also represents a risk. Should Bitcoin fail as an official currency in the Central American nation, then other countries could restrict the use of cryptocurrencies due to the risks involved.

Bitcoin could continue to be used even in the event of a global ban – but this scenario is unlikely.

Conclusion: Bitcoin is so safe

Technically, we can conclude that Bitcoin is secure. The likelihood of a 51 percent attack is extremely low and would not benefit the attackers, especially in the long run. The Bitcoin blockchain has been running stably and securely in more than ten years.

The possibility of a hard fork can quickly rehabilitate the Bitcoin ecosystem. Therefore, we currently see no threat to Bitcoin from a technological perspective.

In fact, humans themselves are the biggest threat to Bitcoin. Thus, there are repeated attempts to manipulate prices, ban crypto, and attack the network.

However, we should not forget that the number of Bitcoin supporters has been growing steadily for years. Thus, a strong community emerges here, who can stand in the way of bans and attacks so that Bitcoin does not fail.