The video “Money Electric: The Bitcoin Mystery” by Cullen Hoback is an interesting look into one of the most mysterious issues in the digital world. The HBO movie talks about the complicated world of cryptocurrencies, focusing on Bitcoin’s secret beginnings and revolutionary potential.

At its heart, the documentary wants to do two very important things. First, it wants to reveal who Satoshi Nakamoto is. Satoshi Nakamoto is the fake name of the hacker who created Bitcoin in 2008. This search is more than just an interest; it’s a study into a technological trend that has tested traditional financial systems.

The movie does more than just explain Bitcoin’s technology. It also goes into great detail about what it means for society and philosophy. Hoback carefully traces the history of cryptocurrency back to the 2008 financial disaster, showing it as a radical response to the problems with traditional banks. The documentary gives a complex picture of a digital currency that is more than just a money tool by talking to important people in the cryptocurrency world, such as Bitcoin advocates and early developers.

The way “Money Electric” deals with the Satoshi Nakamoto mystery is what makes it so interesting. The program doesn’t just look for a name; it also looks into why the person who created Bitcoin is important. Almost a million bitcoins in the original wallet haven’t been used yet. These bitcoins are worth much money, so finding Nakamoto is very important.

Hoback’s video stands out because it shows Bitcoin not just as an interesting piece of technology but as something that could completely change how the world’s financial systems work. It tells the story of how the currency went from being a small-scale digital experiment to a force that has caught the attention of governments, businesses, and creative business leaders like President Nayib Bukele of El Salvador.

In the end, the movie goes beyond just being about technology and becomes a deep reflection on money, power, privacy, and how new technologies can change the way society works.

Digital Revolution: Bitcoin’s Technological Heartbeat

Bitcoin became famous around the world as more than just another currency. It’s a technological protest against standard banking systems. This digital currency, created in 2008 by the mysterious Satoshi Nakamoto, is a completely new way of thinking about how money could work in the digital age.

What makes Bitcoin work is blockchain technology, a digital record that is both open and safe. Imagine a record book that is copied simultaneously on thousands of computers, making it almost impossible to change. Each transaction is recorded permanently and can’t be changed, making for a system with unique financial openness.

Bitcoin’s most innovative trait is that a single group does not control it. Like traditional currencies, Bitcoin is not controlled by the government. Instead, Bitcoin is controlled by its users. It’s a peer-to-peer system, meaning users do business directly with each other instead of going through banks or other middlemen. This cuts down on transaction costs.

Blockchain technology isn’t just used for cryptocurrencies. It could change how things are done in healthcare data and supply chain management. Smart contracts, agreements whose terms are written straight into code and run themselves, are one way this technology could change complicated systems.

Bitcoin is technically very smart because there are only so many of them. There will only ever be 21 million bitcoins, which is very different from regular currencies that can be printed whenever they want. This cap acts like gold or other precious metals, protecting you from inflation.

Bitcoin is more than just an investment for people interested in technology and financial freedom. It’s a statement about how people should handle their money. It challenges old ideas about money and shows a possible future where transactions are truly global, instant, and not controlled by a single organization.

The documentary “Money Electric” does a great job of showing this technological revolution. It takes complicated cryptographic ideas and turns them into an interesting story about power, creativity, and how digital technology could change how we think about value.

Phantom of the Crypto Realm: Satoshi’s Shadowy Legacy

Satoshi Nakamoto is the most famous and mysterious person in cryptocurrency. They are the digital ghost who changed global finance without revealing who they are. It was in 2008 that Nakamoto released a white paper, and it wasn’t until 2009 that the first Bitcoin block was mined.

Nakamoto’s real brilliance isn’t just in technology; it’s in how he thinks and feels. By staying anonymous, they turned Bitcoin from a simple digital cash into a worldwide myth. Imagine making something worth more than $1 trillion and then just… not being there. Nakamoto has about a million bitcoins that haven’t been spent yet. This huge amount of money could throw the world economy into chaos with just one move.

The failure to reveal Nakamoto’s identity has become legendary. The most famous was a cover story in Newsweek in 2014 that misidentified an old man in Los Angeles and made him famous without his knowledge. Cryptographers like Adam Back, Nick Szabo, and Peter Todd have been named as possible creators, but none of them have been proven to be the real ones.

The documentary Money Electric investigates this mystery and shows Nakamoto not only as a person but also as a symbol of technological resistance. Bitcoin is a decentralized currency that cannot be controlled by the government. It was created in response to the 2008 financial crisis to poke fun at standard banking systems.

If Nakamoto’s name is made public, it could break Bitcoin’s mystery. Decentralization and privacy are at the heart of the coin. If the author of Bitcoin is made public, it could hurt the very ideas that made it so revolutionary.

Some think that Nakamoto purposely hid their name, changing from a person to an idea—a digital Robin Hood fighting against banks. Nakamoto is still the most interesting unsolved riddle in cryptocurrency, whether he or she is a single person or a group.

Crypto Pioneers: Architects of Digital Currency

Bitcoin’s story isn’t just a technical one; it’s also a human one, full of rebels, innovators, and complicated people who have changed how digital money works. At the heart of this story are the amazing people who have taken cryptocurrency from an obscure idea to a worldwide success.

It looks like Samson Mow will be Bitcoin’s bravest global advocate. He has traveled worldwide and helped get governments to accept cryptocurrencies. El Salvador was the first country to make Bitcoin legal currency. He’s selling a financial revolution, so his goal goes beyond just making money.

Adam Back is the perfect example of a crypto thinker. Back is a British cryptographer who seems “stoicly bemused.” He is the founder of Blockstream and the creator of Hashcash, a system that came before Bitcoin. He is a key person in the story of cryptocurrencies because he knows a lot about technology and may have a link to Satoshi Nakamoto.

Peter Todd’s work as a Bitcoin Core developer gives him technical respect. Todd represents early cryptocurrency developers’ brilliant, sometimes rebellious spirit and is often talked about as a possible Satoshi candidate.

Also, Roger Ver calls himself the “Bitcoin Jesus” and has been involved in court problems because of his support of cryptocurrency. Ver used to be a strong supporter, but now he shows how complicated and sometimes contradictory it can be to spread the word about digital currencies.

These people aren’t just technologists; they’re digital revolutionaries challenging old-fashioned financial systems. Each brings a different viewpoint to a technology that could change the world’s economy.

Rebellion in Bits: Bitcoin’s Revolutionary Journey

Bitcoin was created from the ashes of the 2008 financial crisis. It was more than just a currency; it was a technology slap in the face to a broken economic system. Some people interested in cryptography saw a chance for significant change when banks failed, and governments rushed to save big banks.

Fundamentalists of the market said that government involvement was the issue, not the answer. Their dream? An autonomous currency that the government couldn’t control, tracked, or manipulated in the usual way. Bitcoin became their digital tool of choice.

The history of cryptocurrencies is like a techno-thriller. Bitcoin went from being an unknown experiment in 2009 to becoming the 10th most valuable currency in the world. Its mysterious genesis block was the first step in this process. Each milestone challenged long-held ideas about money. For example, building a currency that people could use to make transactions directly with each other without banks getting in the way was a big deal.

The road wasn’t smooth, though. Regulatory bodies all over the world were wary of Bitcoin. Extreme price changes meant that overnight, riches could be made or lost. Arguments within the crypto community, like the famous “block size war,” could have broken up the whole movement.

It was expected that governments would fight back. The US tried to limit Bitcoin’s growth because it was very protective of the dollar’s standing as the world’s reserve currency. However, some countries, like El Salvador, saw a chance and made cryptocurrency legal money.

Bitcoin isn’t just a piece of technology; it’s also a moral statement about freedom of money, openness, and how technology can change how economies work. Every transaction is a small defiance against a central bank’s power over money.

Digital Defiance: Cryptocurrency’s Global Rebellion

Bitcoin has gone from a nerdy experiment to something that could change the political landscape and challenge the US’s long-held financial power. El Salvador, whose President Nayib Bukele bravely declared Bitcoin a legal tender, is at the forefront of this change. This move sent shockwaves through the world’s financial systems.

Countries that have had problems with the US in the past see Bitcoin as more than just money; they see it as a strategic tool. By using Bitcoin, these countries might be able to circumvent restrictions on traditional banks, build their own financial networks, and become less reliant on the US dollar.

The documentary shows how Bitcoin ambassadors, such as Samson Mow, carefully travel the world to convince countries to accept Bitcoin. Their pitch is convincing: Bitcoin is an autonomous system that works without government oversight and gives countries that are usually left out of global economic structures financial independence.

The US is not doing anything. The documentary shows complicated efforts to keep the dollar as the world’s reserve currency, such as introducing easy-to-track digital currencies and implementing strict regulatory frameworks. The stakes are very high: Bitcoin directly challenges the dollar’s role as the world’s main currency.

From a geopolitical point of view, Bitcoin is more than just technology; it’s a statement about financial freedom. Every transaction is a small defiance against a central bank’s power over money. Countries think that cryptocurrency could help them break free from standard economic hierarchies.

It’s not just about money; it’s also about power, control, and the future of how economies worldwide will work together. Bitcoin has gone from being an interesting piece of cryptography to something that could cause huge changes in the whole system.

Visual Alchemy: Decoding Complexity on Screen

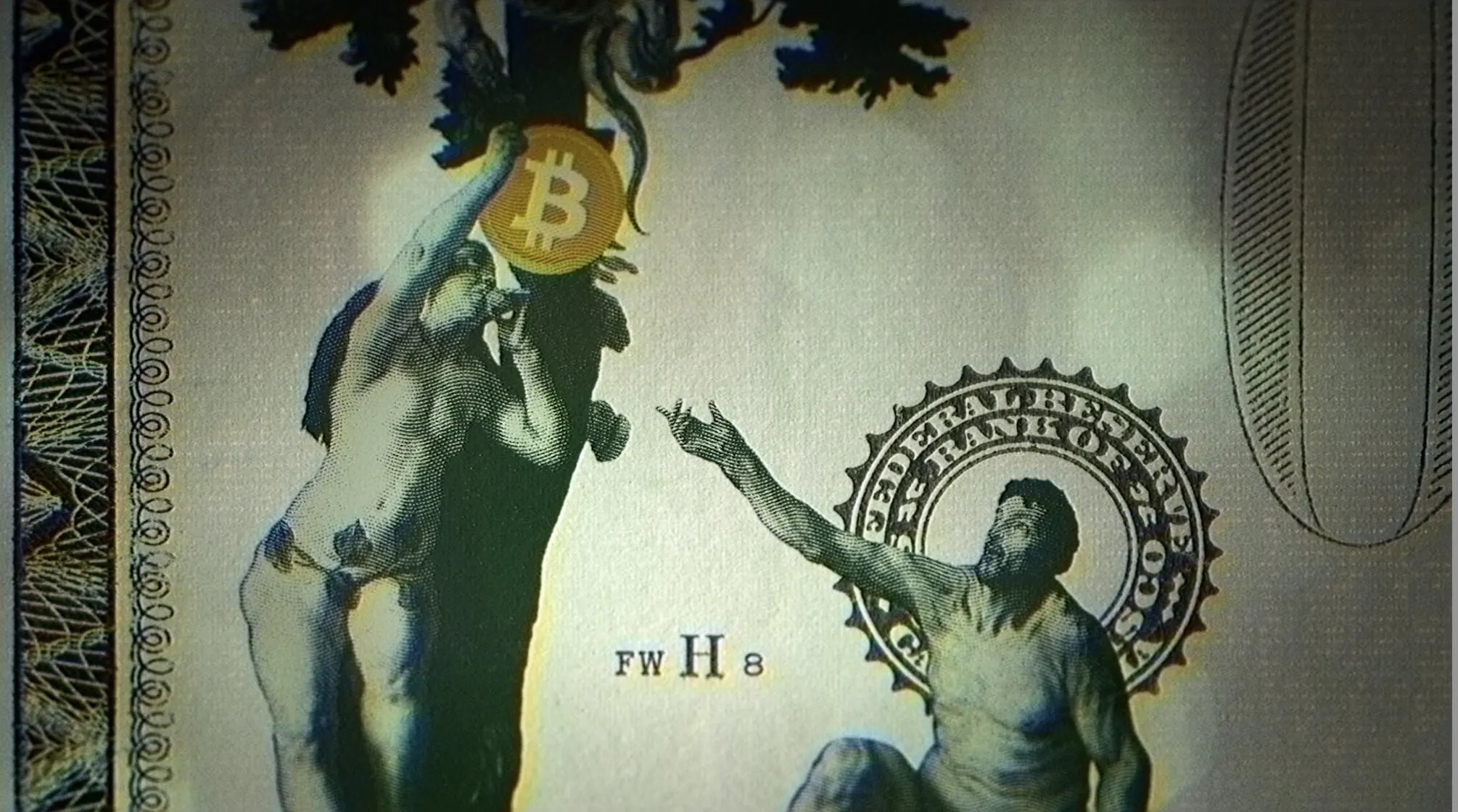

Cullen Hoback uses superb visual storytelling to turn the scary world of cryptocurrency into an easy-to-understand story. The documentary’s images are like cryptographic Rosetta Stones—they break down complicated blockchain ideas into easy-to-understand visual metaphors that even people who aren’t tech-savvy can grasp.

Hoback’s way of doing things is so sure of itself that it’s scary. He uses an investigative style that is part deep dive into technology and part mystery story. He doesn’t just talk about Bitcoin; he turns complicated cryptographic ideas into a story about power, new ideas, and digital revolt.

The movie’s visual tools are especially great. The complicated workings of blockchain are broken down by detailed graphics that make “computer shenanigans” seem real. Strings, keys, and digital coins go from hard-to-understand tech ideas to things people can almost touch and understand.

The interviews are carefully chosen to give the documentary an authoritative tone that goes with its analytical tone. Each expert tells a story about a different part of the world of cryptocurrencies without using too much scientific language.

The story’s framework strikes a fine balance between being technical enough to be believable and mysterious enough to be interesting. Hoback knows that he’s not just explaining a technology; he’s also solving a global mystery that makes us question what we think about power and money.

The most amazing thing about the documentary is that it makes people feel part of a technological revolution rather than just watching a complicated system work.

Digital Frontier: Unraveling Cryptocurrency’s Mythical Landscape

“Money Electric” is more than just a documentary; it’s a technical epic that turns cryptocurrency from a complicated idea based on algorithms into a story about rebellion, innovation, and mystery. Cullen Hoback expertly breaks down Bitcoin’s complicated world, making the incomprehensible suddenly clear.

The movie’s biggest success is making technology seem more like a person. Hoback shows a change going on not only in code but also in people’s minds by focusing on the mysterious Satoshi Nakamoto and the passionate people shaping the future of cryptocurrency.

This video is a great way for people new to crypto to get started. Blockchain fans following it for a while will enjoy this in-depth look at Bitcoin’s deeper philosophical meanings. You need to understand a digital currency and how it might change the way global financial systems work.

It seems like the point of the documentary was to leave viewers with more questions than solutions. “Money Electric” does more than just explain Bitcoin; it encourages more research by showing its complexity while still keeping the technology mystery.

In the end, this movie is about more than just bitcoin. It’s a deep reflection on how technology can change how we think about value, question established power structures, and rethink economic systems.

This book is recommended for anyone interested in how science, economics, and human potential affect each other.

The Review

Money Electric: The Bitcoin Mystery

"Money Electric: The Bitcoin Mystery" is an interesting video that goes beyond the usual ways of discussing technology. Cullen Hoback writes an intellectual thriller that demystifies Bitcoin while keeping its mysterious nature by turning complicated cryptocurrency ideas into an engaging human story. The movie does a great job of balancing technical detail with story drive, making the complicated blockchain world exciting and easy to understand. Hoback's video isn't just about Bitcoin; it's a philosophical look at how technology can change our thoughts about money. The movie shows cryptocurrency not just as a way to make money but also as something that could change the world's economy. It does this through smart interviews, amazing graphics, and an investigative style. Even though there are some technical problems, the documentary does a great job of keeping viewers interested by focusing on the people affected by the digital change. Its investigation into Satoshi Nakamoto's elusive identity adds an extra layer of intrigue to keep crypto fans and regular people interested.

PROS

- Exceptional storytelling that transforms complex technical concepts into a compelling narrative

- Masterful visualization of blockchain and cryptocurrency mechanisms

- In-depth exploration of Satoshi Nakamoto's mysterious identity

- Balanced perspective on Bitcoin's technological and philosophical implications

- Engaging interview selection with key cryptocurrency figures

CONS

- Occasional overly technical explanations

- Might be challenging for viewers with limited technological background

- Some complex concepts may require multiple viewings

- Potential bias in expert selection